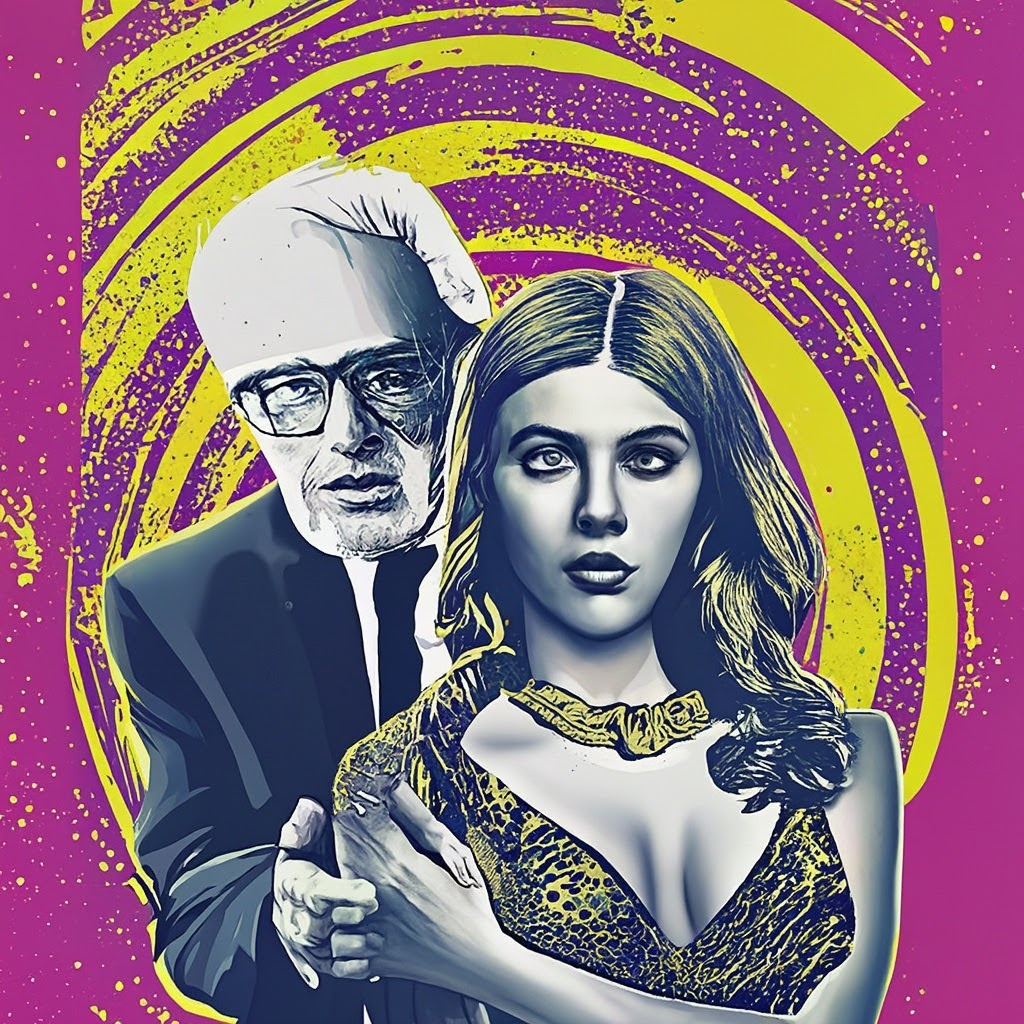

Protect your financial legacy from gold-diggers and fraud

It's your legacy to protect

How would you feel if you knew that your kids would never get the financial nest egg you worked so hard to provide for them? As unthinkable as it sounds, your kids can be cut out of the family estate when a deceased spouse leaves everything to the surviving spouse (which is very common). This can all be solved with good estate planning.

Why You Need to Protect Your Children’s Inheritance

Many couples believe that signing wills leaving everything to the surviving spouse or jointly titling all property is a good estate plan. The truth is, both strategies can create risks that can place your family’s financial legacy in the hands of a stranger or gold digger.

How Does a Stranger or Gold Digger Get Your Family’s Financial Legacy?

Someone outside your family can end up with your family legacy in several different situations. The following true story can show you just how this happens. (To protect the family, these are not the real names.)

John and Mary were happily married for many years. They had three children. As the couple grew older, John developed health problems. Mary became his full-time caregiver. When Mary died suddenly and unexpectedly, the family was devastated.

Mary’s will left her entire estate to John. The will also stated that if John predeceased her, the children would receive the estate. John had a similar will.

John’s children wanted to make sure that John received the care he needed. Since they all had busy young families of their own, the children found a highly recommended (but unlicensed) caregiver for John.

The caregiver faithfully tended to all of John’s needs every day. John’s children and grandchildren visited him when their own schedules allowed.

Several years later, John passed away. The children were shocked to discover that John had changed his will and left his entire estate to the caregiver. His will also provided that if the caregiver predeceased him, the caregiver’s daughter inherited the estate. John left nothing to his children.

John’s children looked into filing a lawsuit to contest the will. However, evidence in the case demonstrated that John understood the nature and effect of his will at the time he signed it. He intended to leave everything to the caregiver, who took very good care of him on a daily basis. He felt the children did not visit or care enough to benefit from his estate. Unfortunately, his children received none of the assets that he and their mom had worked so hard to earn. They felt like they were cheated out of their family’s legacy.

Caregivers, Late Life Marriages and Relationships, and Fraud

The events involving John’s family occurred because Mary’s will left her entire estate outright to John. From that point forward, John was free to manage and control the assets as he pleased, including providing for their disposition after his death in his will.

Caregivers are only one example of how a financial legacy ends up in the hands of a stranger. When a surviving spouse receives an entire estate under a will, the same result can occur because of a late life second marriage or relationship, or when a single family member takes advantage of an elder surviving spouse.

Sometimes fraud is involved — individuals who cultivate relationships with a surviving spouse might be gold diggers. Other times, as in John’s case, fraud is not a factor. In the absence of a legal reason to invalidate a surviving spouse’s will that leaves the entire estate to a stranger, the children receive nothing. No matter how the situation arises, it can result in depriving the children of the family financial legacy that the parents originally intended them to have.

How You Can Protect Your Kids' Inheritance

If you and your spouse execute wills leaving your estates outright to each other, you run the risk that a stranger or gold digger will end up with your family’s financial legacy. To make certain that your children receive their inheritance after you and your spouse pass away, careful estate planning with assistance from an experienced attorney is essential.

In most situations where a married couple owns substantial assets to pass along to their children, a trust is the appropriate estate planning tool to use. It is important to discuss your needs and wishes with a board-certified attorney to determine the right type of trust and appropriate terms to accomplish all your goals.

A word of caution is extremely important, especially given the ready availability of online forms and services for Do-It-Yourself (DIY) estate plans, including will and trusts. If you use forms or online services to set up your estate, you run a substantial risk that you will not succeed in accomplishing your goals. Talking with a knowledgeable estate planning attorney is the only way to make sure you put in place an estate plan that protects you and your family now and in the future.

Talk With an Experienced Estate Planning Attorney to Ensure You Protect Your Kids' Inheritance

At The J.M. Dickerson Law Firm, we focus on protecting our clients and their assets, whatever their unique circumstances may be. Ensuring that children benefit from the family legacy is an important goal for many of our clients.

We provide estate planning services to clients throughout South and Central Texas. Please contact us today, we are happy to share our expertise with you so you can make the best decisions for passing on your financial legacy.

CONTACT INFORMATION